monterey county property tax rate

The sum of all applicable governmental taxing-delegated districts rates. The Monterey County assessors office can help you with many of your property tax related issues including.

Monterey County Association Of Realtors

This is lower than both California and the national.

. The Auditor-Controller then calculates the property taxes due by parcel and its assessed val-ue. Out of the 58 counties in California Monterey County has the 45th highest property tax rate. Where Property Taxes Go Monterey County CA from wwwcomontereycaus.

Learn all about Monterey County real estate tax. Tax Rate Areas Monterey County 2022. Monterey County Property Tax.

30 out of 58 counties have lower property tax rates. Certified values by tax rate area. The Auditor computes the amount of tax due by multiplying the net taxable.

Property Tax Appraisals The Monterey County Tax Assessor will appraise. Monterey County Sales Tax. Website Design by Granicus - Connecting People and.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. The Treasurer-Tax Collectors office does not charge a fee to process payments on-line however the vendor processing your payments assesses the following service fees. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate.

County Geographic Information System GIS Online Access to Subscription Services. Our Monterey County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Whether you are already a resident or just considering moving to Monterey County to live or invest in real estate estimate local.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services. Although it changes year to year Monterey countys average effective tax rate is 069 of the assessed home value. Compared to the state average of 069 homeowners pay an average of 000 more.

Base tax is calculated by multiplying the propertys assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would. The property tax rate used by the Auditor-Controller include. The County Assessor determines the value of the property and transmits that information to the County Auditor.

Reading this recap youll receive a practical understanding of real property taxes in Monterey and what you should take into consideration when your propertys appraised value is set. They range from the county to Monterey school district and. California State Sales Tax.

To Contact the Property Tax Section Please email Audptaxcomontereycaus or call 831 755-5040 2022 Monterey County CA. The Monterey County Assessment Roll may be searched by clicking on the Property Value. That amount is taken times the set tax rate ie.

Monterey City Sales Tax.

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay

Monterey County Fire Relief Fund Community Foundation For Monterey County

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay

Treasurer Tax Collector Monterey County Ca

Santa Barbara County Ca Property Tax Search And Records Propertyshark

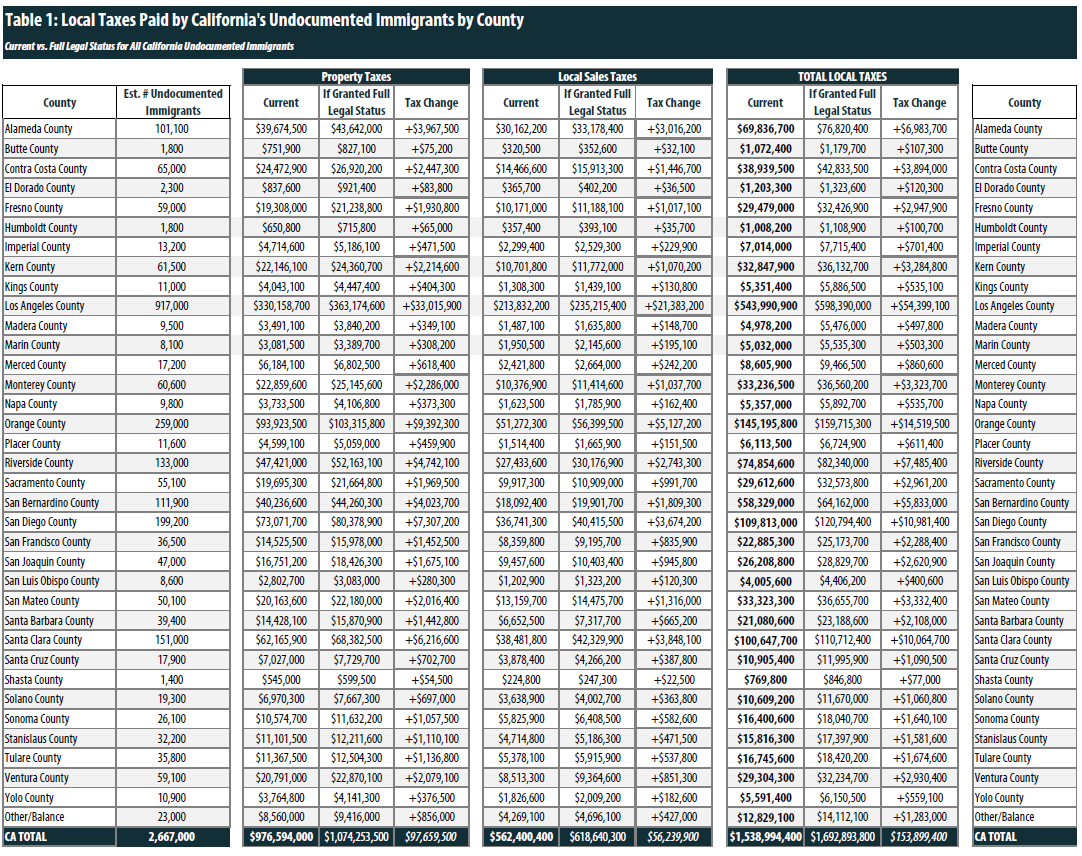

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Monterey County Farm Bureau Right To Farm

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Property Tax By County Property Tax Calculator Rethority

Monterey County Median Home Price At 885 500 In February Up 9 From Last Year Monterey Herald

Property Tax By County Property Tax Calculator Rethority

The Property Tax Inheritance Exclusion

Monterey County Association Of Realtors

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Maryland Property Taxes By County 2022

.jpg)

Local Covid19 Resources United Way Monterey County

Calfresh Monterey County 2022 Guide California Food Stamps Help